Unveiling dYdX: Pioneering Decentralized Trading Platforms and Acquisition Strategies

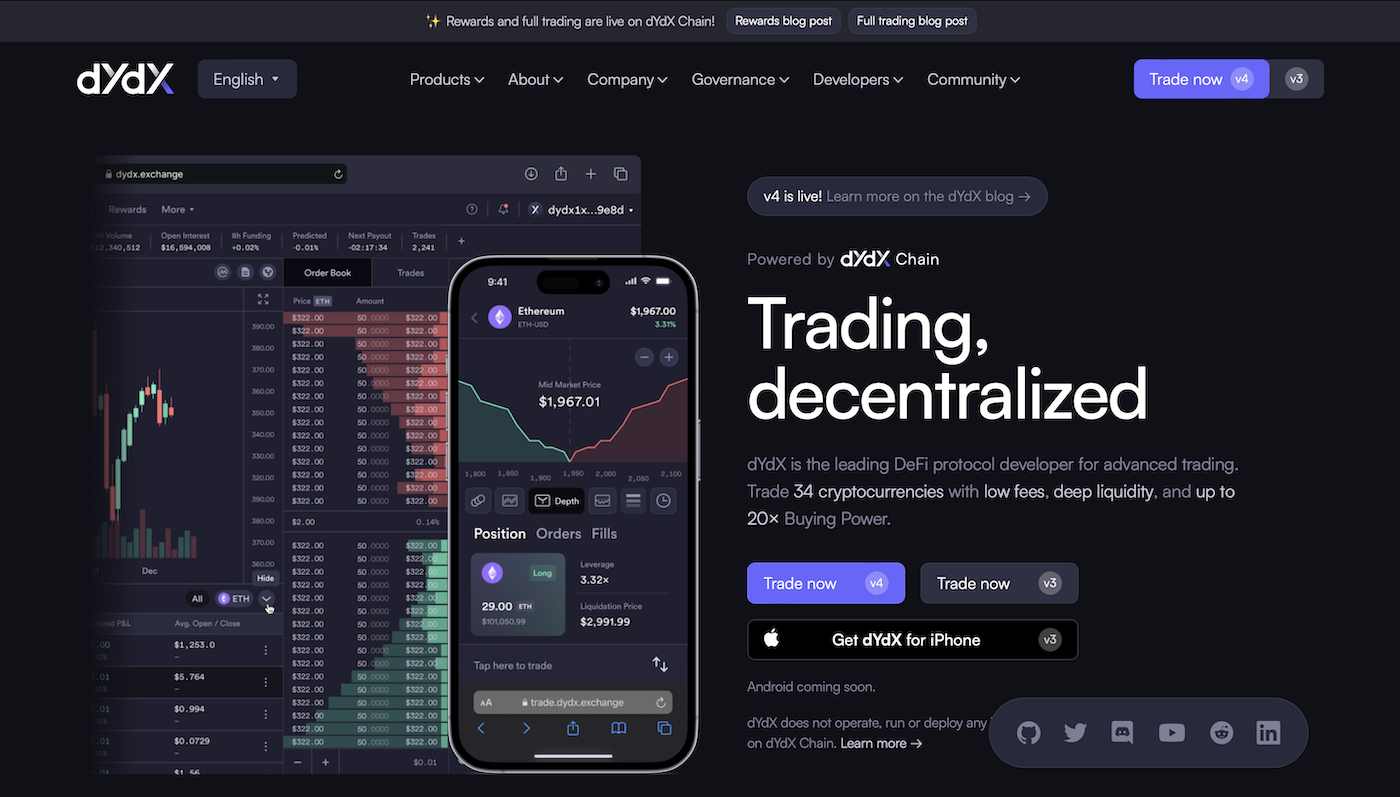

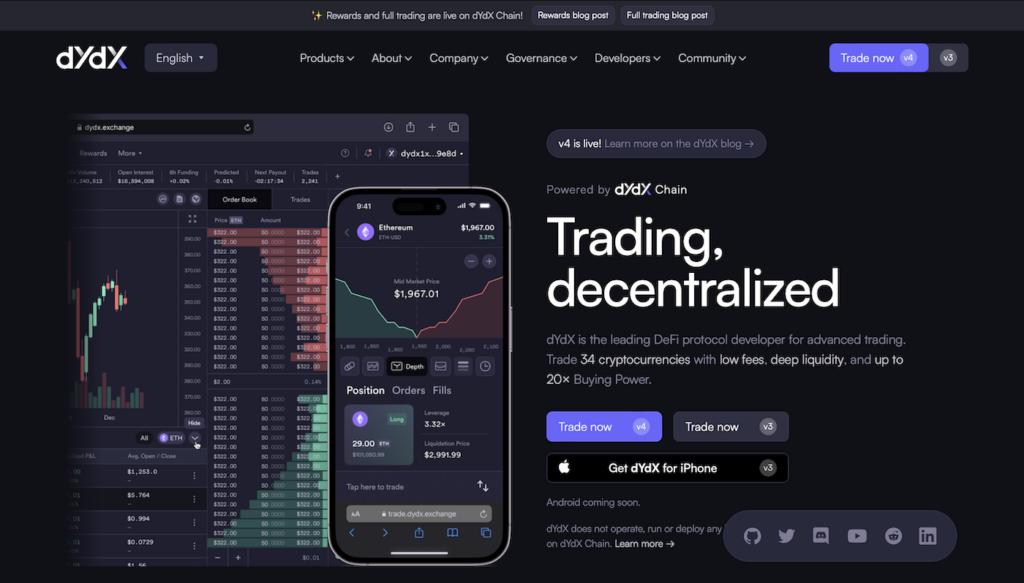

In the realm of decentralized trading platforms, dYdX is a trailblazer utilizing Ethereum smart contracts to amplify spot and margin trading opportunities. Much like its counterparts, both centralized and decentralized, dYdX boasts an array of trading functionalities, encompassing stop-loss and limit orders.

The landscape of cryptocurrency is in a perpetual state of evolution

with decentralized exchanges (DEXs) like dYdX leading the charge. dYdX has been generating substantial buzz owing to its transition to an autonomous blockchain and the introduction of advanced trading capabilities. Let’s delve into the distinctive features that set dYdX apart and forecast its potential success akin to platforms such as Uniswap in the forthcoming bull cycle.

Fundamentally, dYdX comprises a suite of smart contracts initially deployed on the Ethereum blockchain. These contracts facilitate perpetual contract trading through an interface reminiscent of centralized exchanges, obviating the need for traders to directly deposit funds onto the platform.

dYdX stands tall as a decentralized exchange (DEX) platform

offering perpetual trading options for over 35 prominent cryptocurrencies, including Bitcoin, Ether, Dogecoin, and Cardano. It commands a significant presence in the decentralized exchange landscape, boasting substantial trading volume and market share.

Conceived by Antonio Juliano, an enterprising Californian entrepreneur, dYdX was born in August 2017, with its official launch in July 2017, initially offering crypto margin trading, lending, and borrowing services over Ethereum layer-1.

Fast forward to August 2021, dYdX expanded its offerings to include cross-margin perpetual trading. In cross-margin trading, users can repurpose their available balances on the platform to provide liquidity to existing trades—a favored approach to circumvent liquidations during periods of heightened volatility.

The dYdX protocol is underpinned by Ethereum smart contracts and STARK (zero-knowledge) Rollups powered by Starkware. Commencing its journey in the cryptosphere with spot trading, the platform has since undergone three iterations to decentralize its components. In a bid to decentralize the exchange, dYdX predominantly relies on trustless protocols, which are publicly extensible without any permissions.

Perpetual trading/contracts vs. traditional contracts vs. spot trading

To grasp the modus operandi of dYdX, it’s imperative to discern the diverse trading options prevalent in the market and their key disparities.

Perpetual futures contracts, or simply perpetual contracts, empower users and investors to place buy or sell orders at fixed prices indefinitely, sans an expiry date. This contrasts with spot trading, which entails instantaneous buying or selling of cryptocurrencies based on prevailing market prices. Traditional futures contracts, conversely, entail a time limit on each order, automatically terminating upon expiry.

As a decentralized exchange, dYdX primarily hosts perpetual markets that have expanded to encompass spot and margin trading on both Ethereum layer-1 and layer-2 cross-margin perpetuals.

Trading options on the dYdX exchange - "Over the years, dYdX has pursued incremental advancements in rolling out new service offerings as part of its ongoing decentralization efforts."

Perpetual trading on the dYdX exchange

Perpetual trading stands as dYdX’s flagship offering, enabling users to engage in open markets via non-expiring contracts. Consequently, investors retain their buy or sell positions indefinitely until predetermined trade conditions are met. For instance, if a user places an order to sell 1 Bitcoin at $100,000, the order remains active until Bitcoin hits $100,000 and the trade concludes. However, investors have the option to terminate contracts by pre-closing buy or sell orders.

The dYdX perpetual presents itself as a non-custodial, decentralized margin product offering synthetic exposure to various crypto assets. Built atop underlying assets, in dYdX’s case, Ethereum-based ERC-20 tokens, perpetual contracts facilitate the creation of entirely new asset classes deriving value from underlying blockchain-based assets.

Governance and staking in dYdX

Approximately a year post the platform’s launch, dYdX introduced DYDX, the governance token for the dYdX protocol. Users can earn DYDX tokens through trading activities on the DEX, inclusive of all fees and open interest.

The community arm of the dYdX exchange enables users to stake their existing crypto holdings to earn yields in DYDX, the proprietary governance token. The exchange presents two pools—the liquidity pool and the safety pool—where users can stake USD Coin (USDC) and earn rewards for bolstering dYdX exchange liquidity.

Moreover, DYDX tokens find utility on the platform for community voting and governance endeavors. Users leverage their DYDX reserves to participate in community proposals concerning module upgrades, restorations, and grants. Additionally, users can support the community by investing in DYDX tokens through popular crypto exchanges such as Kraken and Coinbase.

Non-fungible tokens on dYdX dYdX’s latest product offering manifests in an NFT collection christened Hedgies, comprising animated hedgehogs crafted by independent digital artists Anna and Arek Kajda. The NFT collection debuted in February 2022, minting 4,200 NFTs over the Ethereum blockchain.

Hedgies are distributed to users based on their trading statistics and community engagement, including voting. Owners of Hedgies NFTs enjoy certain perks while trading on dYdX. Minting Hedgies entails only gas fees and serves as a means to reward users for various milestones and achievements.

Spot and margin trading on dYdX (legacy)

Previously, dYdX offered spot and margin trading services over the Ethereum layer-1 blockchain protocol. However, the exchange discontinued its layer-1 offerings on November 1, 2021, transitioning to offering layer-2 perpetual products, aligning with its aspiration to evolve into a fully decentralized exchange.

The dYdX exchange harnesses Ethereum smart contracts for spot and margin trades, akin to other centralized and decentralized exchanges. The platform also encompasses trading features such as stop-loss and limit orders.

The future of dYdX decentralized exchange For dYdX, the roadmap is paved with aspirations of achieving complete decentralization by the conclusion of 2022. Presently in its third iteration, the decentralized exchange aims to operate devoid of centralized components with dYdX v4.

Most components of the dYdX v3 platform are decentralized; however, the company leans on centralized systems for the order book and matching engine. Full decentralization of the dYdX platform entails decentralization of the order book and matching engine.

The fourth version of the dYdX protocol will debut as an open-source, decentralized, and community-controlled trading platform. Besides embracing full decentralization, dYdX v4 is slated to reintroduce trading features such as spot and margin trading, alongside additional synthetic products. The company also intends to enhance existing

Get a Free Consultation to Boost Your Business.

INSIDER SOCIAL MARKETING